According to Citi, the space industry is on track to generate $1 trillion in revenue by 2040, with launch costs reducing by 95% to enable more services to be delivered from space.

The value of the global space industry reached $424 billion in 2020, having grown by 70% since 2010.

The satellite market is undergoing a paradigm shift, with more global access to internet service. The question is, how will you differentiate your value?

This reminds us of Adam Smith’s The Paradox of Value or the Diamond-Water Paradox, which is articulated by the renowned economist and philosopher.

The paradox of value, often known as the diamond-water paradox, describes the belief that, despite the fact that water is more vital for our survival, diamonds fetch a greater market price. This introduce the concept of marginal utility

In the diamond-water paradox, it was determined that each unit’s utility, not the entire usefulness, affects pricing. People require water to survive, hence its value is huge. Due of its abundance, water’s marginal utility is low. Each additional unit of water can be used for less urgent uses as more urgent needs are met.

As water supplies expand, people value each unit less. Diamonds are scarcer. One more diamond is exponentially more valuable than one more glass of water, which is abundant. People value diamonds higher. Diamond buyers are willing to pay more for one diamond than for one glass of water, and sellers seek more.

Except…

A man dying of thirst would have more marginal use for water than diamonds, so he would pay more for water, maybe until he stopped dying.

Water has a higher marginal utility than diamonds at low consumption levels, making it more valuable. People drink more water than diamonds, hence water’s marginal utility and price are lower.

As more constellations are launched, the marginal utility and price will fall, raising the question of how you will define your value.

People use a variety of value terminology in business, including business value, customer value, product value, as well as value propositions, value chains, and so on.

And people enjoy claiming that they are generating, capturing, and providing value.

This article will look at the importance of value creation, particularly in the satcom business, and how to include it into your strategy if you haven’t already.

The value is in the service and lies in the mind of the receiver

In the digital economy, Value-as-a-service is not a new approach to create value. It has emerged as a response to the increased demand for individualised services that addresses real customer needs.

From strategy, channel engagement, product, services, pricing, positioning, marketing, and all the way to your business models of B2B or B2C, value is the cornerstone of everything you do in a business.

The key principle behind this notion is that it gives customers personalised solutions, that save time, reduce cost, relieve anxiety, and eliminates the need for them to search for and find it elsewhere. Many businesses, like Airbnb, Uber, Amazon Prime, SpaceX have successfully utilised this strategy.

A VaaS strategy is an alternative to the standard fee-for-service model, in which the customer pays for each transaction separately.

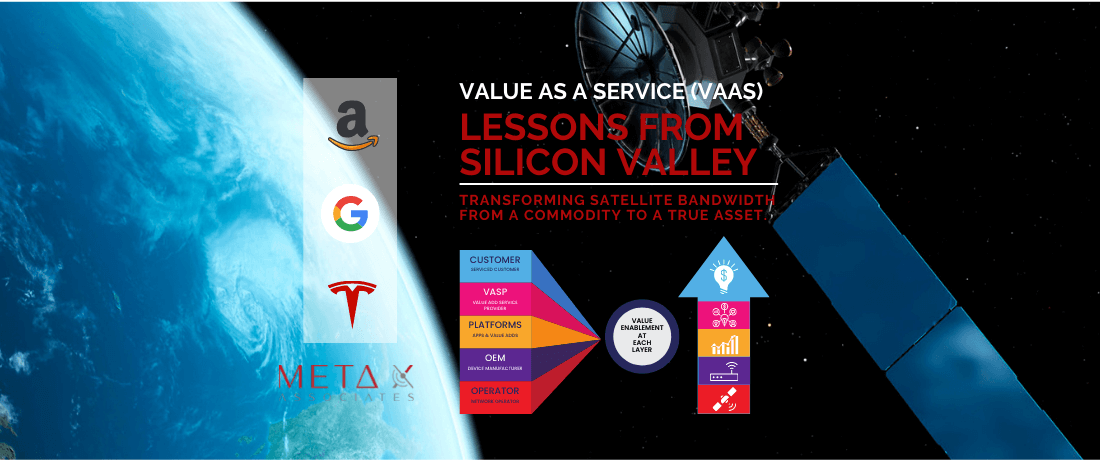

Interestingly, we are seeing interest from major tech companies in the satellite business that have built their businesses on a VaaS model. Freemium pricing, freemium advertising, freemium content marketing, and data mining as a service are some of the most common VAS models. Facebook, Google, and Amazon have their constellations planned, and connectivity is only an enabler for creating additional value for the end user; the traditional satellite industry has a lot to catch up.

B2B Challenge

Commoditisation and shorter product life cycles are two consequences of the increasing globalisation of markets. When a product or service hits the market, competitors from all over the world rush in and profit margins start to drop. There are quite few ways to differentiate on a global scale.

B2B The Elements of Value, written by Bain Consulting, was published in the Harvard Business Review in 2018. Bain has organised the 40 different types of value that B2B services provide to customers into a five-tiered pyramid. The most objective categories of value are located at the bottom, and as a level rises, the more subjective and personal the types of value it contains.

There is no product or service that contains all pyramid components. Based on real-world examples, these taxonomies establish a wide range of explicit values that may be used to undertake systematic debates about value generation, value delivery, value chains, and so on. A more explicit and precise strategy must be used to identify the value(s) that your organisation, products, or services provide.

According to a survey conducted by Bain Consulting, clients place the greatest value on cost reduction. However, a statistical analysis of supplier ratings and Net Promoter Scores revealed that product quality, vendor competence, and responsiveness were more important drivers of customer loyalty. Cost reduction ranked 27th among loyalty criteria other than table stakes.

Even if a product or service is great, customers and other stakeholders may opt for a different vendor if they dislike the simplicity of integration, ordering procedure, service provisioning, or solutions support, to mention a few concerns.

Many companies adjust prices to boost profits when demand is stable. Higher prices also impact the value equation for stakeholders, so any debate about rising prices should include value factors.

Here is an example: Amazon prime shows the power of adding value to a basic offering before increasing the price. The company initially focused on providing unlimited two-day shipping for $79 annually. Prime then added streaming media, unlimited picture storage, and other perks. Each new element helped Amazon’s services rise above commodity status. Prime’s 40% U.S. penetration allowed the company to raise its yearly charge to $99.

Traditionally, the satellite communications sector has been seen as a commodity market for satellite hardware and associated data plans. That is why, when asked what is most important to end customers, cost savings come out on top.

However, satcom businesses can still differentiate themselves by analysing and delivering on missing elements at all levels. Despite the fact that end customers said that cost savings were the most important factor in their decisions, product quality, knowledge, and responsiveness emerged as the strongest predictors of customer loyalty.

The real value comes when you subscribe to VaaS and target a specific problem with a specific measurable outcome.

Example: If you subscribe to a $500K per year automation as a service inclusive of satellite connectivity and you can save $5 million in direct savings yearly and $2 million in process efficiency over two years. Thats not a commodity! That is real value creation! This VaaS company will last the test of time. It’s a customer-focused company. Such company values its owners, partners, and customers.

In B2B markets Value creation must occur throughout the value chain, and the higher you are in the value chain, the greater your responsibility in enabling your value chain..

What is the Value of Services and Why You Need to Offer it?

The concept of value-as-a-service has been around for a long time. However, as the number of SaaS companies grows, it has recently gained increasing attention. The key reason for this is that more individuals are realising the value of recurring revenue and how it can be used to exponentially develop enterprises.

Value-as-a-Service Providers (VASP) are enterprises that provide other businesses with the tools and resources they need to function efficiently. They can be large or small and provide services in a variety of industries.

The major purpose of the Value-as-a-Service Provider is to assist clients in developing an effective business that will allow them to succeed in their industry and deliver value to their customers.

Value-as-a-service is a marketing and sales technique in which clients pay a monthly fee for a collection of products and services. It’s a great approach to boost client retention, generate new leads, and develop new revenue streams.

Business Strategy Creation: How To Create A Plan For Value As A Service

Value as a service is a way of thinking about how to give your customers something of value.

VALUE = Customer Benefit – Cost to the Customer

The Value as a Service (VaaS) method serves as the foundation of the VaaS strategy. The VaaS procedure is divided into 6 steps:

Creating a Value As A Service Offering

In the digital age, value-added services are critical for a company’s growth and success. They allow businesses to distinguish themselves from their competitors.

The process of providing value-added services consists of two major steps:

- Strategy

- Implementation.

The strategy phase is where the organisation decides what types of value-added services it wants to offer, who it wants to give them to, and how it will implement them.

The implementation phase is where the company puts the strategy outlined in step one into action. This comprises planning a customer acquisition strategy, designing the service offering, and constructing a marketing plan.

Opportunities for Satellite Operators

Selling bandwidth and non-intelligent devices will not provide the necessary differentiator for customer retention and acquisition, as well as VASP. In today’s era of smart devices and intelligence that already exist in the palm of customer hands, customers are willing to pay for a service that benefits them rather than merely acquiring a data plan.

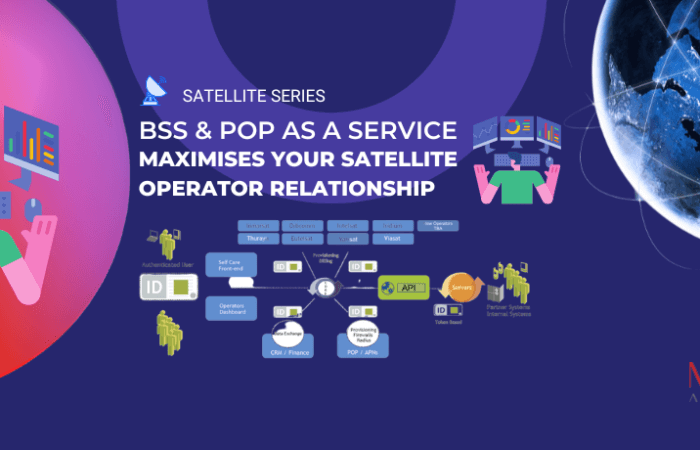

There is a lot of unlocked potential in the value chain that a satellite operator can unlock through enablement and by generating new revenue streams for the value chain. OEM, Core Networks, Spacecraft, Cloud, and edge infrastructure service definitions must enable and establish new revenue streams for everyone in the value chain.

It is vital to highlight that the value proposition is important for both channel partners and end customers. How simple it is to do business, integration opportunities for channel partners, simple yet flexible value adds as a service that allows even a regional smaller player to benefit from services. In most cases, operator level integration lacks innovation and speed, and there is a lack of good big data on which a partner can build. Products & service portfolio must provide more in order to justify a loyal relationship.

Opportunities for Satellite OEMs

Satellite manufacturers have been developing cutting-edge technology to connect the world’s assets on land, in the air, and at sea. However, big data and application enablement which has been there for a while, has been overlooked for years. Edge intelligence, processing, standard industry APIs, onboard common off the shelf sensors and protocols support, and in some cases common LPWAN gateways all play vital roles in the satellite sector, and having them can open up new revenue streams for OEMs.

Edge enablement enables newer players, such as platform and application providers, to embed and develop services based on intelligent hardware.

Customers want more than simply low-priced or high-performance technology; they want value-added partnerships and more strategic offers that help them reach their goals faster, at a lower cost, and with better support throughout the hardware’s life cycle.

Every organisation worries about CAPEX investment. Buying hardware outright that also would depreciate over time, creates financial complexity for the customers.

Companies benefit from newer devices that require less maintenance or downtime, require less support, and have a better relationship with their end users. Hardware as a service (HaaS) is one model that can be used.

Opportunities for Service Providers >> VASP

The holy grail of the entire value chain are service & solution providers. Because of their close proximity to their consumers, there is a growing expectation from them to understand customer problems, find a solution, and then create value through value added services that allow their customers to outperform their competitors.

To become a trusted Value add service provider VASP, service providers must think about how to differentiate themselves through value adds and adapt quicker than their end customers.

Connecting with prominent network operators, including IIOT, having your own billing and provisioning environment, access to your own point of presence POP, vertically focused value added solutions, and offering integration services can all lead to new revenue streams. Strategic partnerships can be used to leverage all of the above.

The following are some key criteria of a feature or service that could be classed as your value add:

- It adds value and complements key products and services.

- It creates more revenue through direct sales or by helping to boost retention.

- It is profitable on its own, which means that the return on investment from supplying the product covers the cost of the product and/or it is funded by charging a fee for it.

- It has the potential to increase demand for your core products and services.

The Future of VASP Value Creation

We can see that value creation involves not only the product itself, but also how it is understood and delivers value to each stakeholder in the value chain leading all the way to the customer. Value creation is not a one-time event; rather, it must be done continuously and on a regular basis.

Meta X Associates has helped some of the most prominent operators, service providers and startups become Value Add Service Providers VASP. Our value is to become your co-innovation and value creation partner, from strategy to implementation and everything in between.

We help you uncover value gaps in your value chain through impartial benchmarking, giving business executives with vital information about where and how to improve and create new business value. We bring an objective viewpoint based on our many years of experience working with satellite operators, global service providers, application and platform providers, end users, as well as our grasp of the ecosystem and vertical knowledge, to help you advance.

As a Co-Partner, we assess and refine value concepts to help you understand how they fit into the broader customer experience and identify the practical results customers would expect from any enhancements

Credits: Hbr.org, Bain consulting